Will robots replace your job? Hey! That’s actually a good question. Advances in technology covers everything from biotechnology to artificial intelligence. The coming flood of change, innovation and creative destruction will have far-reaching effects on your life – and your personal finances.

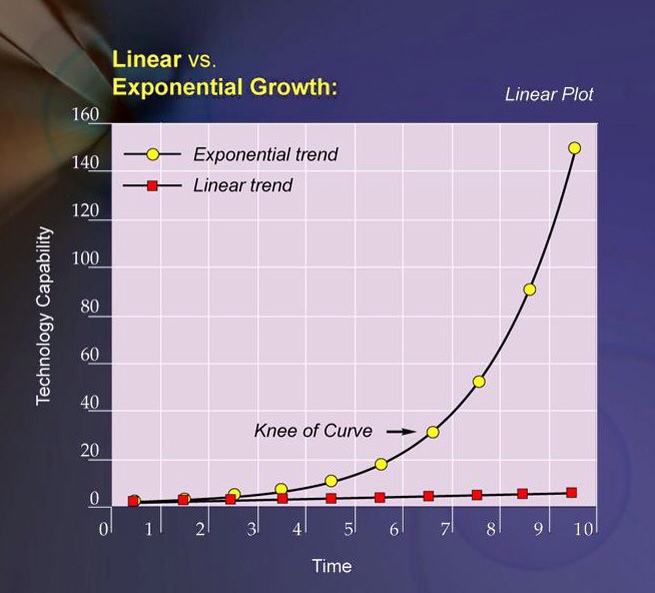

Technology is advancing exponentially. But what does that mean? The difference between a gradual or “linear” progression and an “exponential” progression is important to understand.

The chart on the left shows how initially, linear and exponential changes look similar, but at some point, we reach the knee of the curve, and then there is a massive difference between the two progressions.

Think of laying down a stack of paper and putting down 50 sheets. Maybe the pile is about one inch high. Now think about folding a big piece of paper in half 50 times. (This is an example of an exponential increase where the pile doubles in height each time we fold the paper) Assuming we could do this, how high would it be? Maybe a few feet? Actually, the pile would extend to the moon and back – more than once! …of course we would run out of trees first, but I digress.

This is an extremely important notion to grasp. Why?

- Because we think linearly.

- We conceptualize the future in a linear fashion.

- We think the future is a gradual progression based on the past.

- An exponential rate of change does not compute.

- We have a really hard time grokking an exponential future.

- Yes, I am repeating myself.

Because of the way we think about the future, we typically under-estimate the impact of exponential changes. Technology is advancing exponentially. Partly because the new technology is used to create the more powerful successor. How is this, and will this, show up in our financial lives?

Living Longer

Medical science has become an information technology (subject to exponential advance). This has happened only relatively recently so there is still much skepticism – but as mentioned above, that is to be expected.

Advances in biotechnology, genetic therapies, DoItYourself data sharing, smarter machines will lead to new treatments, new cures, new preventions…essentially the end of illness. The side effect is a longer lifespan.

Living longer means you will need your money to last longer. Or, you will need to earn money longer. Or more likely a combination of the two. Since previously, dying was a key way to curtail your expenses, that method may not be available to you going forward.

Employment Challenges

Yes, robots WILL take your job…at least it will take quite a few jobs. This is already happening and is a contributor to the slow ‘recovery’ in employment. If you are a company, why not make use of new technology to do some of the work you previously had to hire someone to do? You know your costs, the machine does not ask for benefits or raises, and can keep working 24/7.

Famous entrepreneur Vinod Khosla predicts that 80% of the activities of medical doctors will be replaced by smart machines. Already, IBM’s Watson computer – who in 2011 beat the best Jeopardy champions – is being trained to assist in medical diagnoses. At first as an aide to doctors (like having a Dr. House on your iPhone), but likely replacing that function altogether at some point. My own profession, financial planning, is subject to artificial intelligence replacement for most of what financial planners do. The person to person interactions in many professions will be more just explaining what the machine came up with, versus being the machine.

For sure, new types of jobs will emerge, but it is worth thinking about whether your job – or even the company or industry you are in, is subject to “creative destruction” or perhaps “massive productivity increases” also known as, “You’re fired!” just like the employees at BlockBuster Video, or many travel agents, local book stores, etc.,etc.

Market & Economic Gyrations

Speaking of “creative destruction”, 3D-printing is bound to create some hiccups in the manufacturing sector. This will even extend to housing/construction as large 3D printers get busy printing houses. There will be an acceleration of carpets being pulled out from under one’s investment legs as businesses (even long-time buy-and-hold-forwever stocks) get side-swiped by cheaper innovations. Investors will need to look under the cover to their stocks’ ability to keep up, or at least buy-out and incorporate the up and coming new technology upstarts. On the other hand, there will be extraordinary opportunities for companies that spring from $1 million to multi-billion enterprises due to technological breakthroughs.

On a bigger scale, how safe will pensions and health care benefits be if people live much longer, and have many new technologies they feel are essential medical expenses?

So, back to the title of this article “How Technology Will Impact Your Financial Future” … the short answer is, “A lot!”

Michael Nuschke